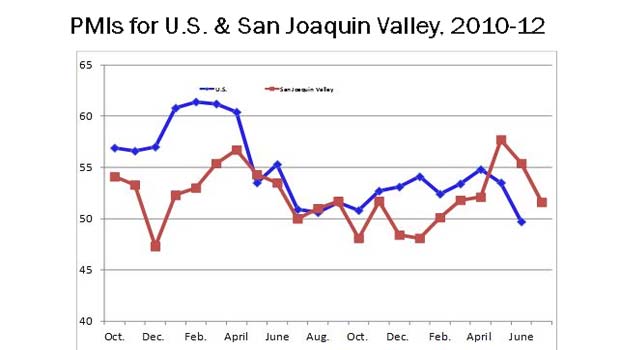

The July San Joaquin Valley Business Conditions Index, issued by the Craig School of Business at Fresno State, declined for a second straight month. By remaining above growth neutral 50 for the sixth straight month, though, it signaled slowly improving economic conditions in the months ahead.

The index is a leading economic indicator from a survey of individuals making company purchasing decisions in Fresno, Madera, Kings and Tulare counties and is produced using the same methodology as that of the national Institute for Supply Management (www.ism.ws).

Here’s a look at other highlights from the July report:

- New export orders plummet.

- Business confidence slumps.

- Slow but positive job additions.

The index is produced by Dr. Ernie Goss, a research associate with the Craig School, slid to 51.6 from June’s 55.4. An index greater than 50 indicates an expansionary economy over the next three to six months. “We are beginning to see slight improvements in the area’s construction sector and businesses tied to construction,” Goss noted. “However, it is too early to call this a rebound. This month, we did see a pullback in firms tied to agriculture and international markets.”

This month, supply managers were asked the biggest hurdle facing their firm in the next year. The largest share, 27 percent, indicated that the end of the so-called Bush tax cuts at year’s end posed the biggest threat to their company’s 2013 business. Another quarter of respondents cited the housing sector; 22 percent European economic turmoil: 13 percent each for implementation of healthcare reform and lack of wage growth.

Employment: The hiring gauge dipped to 51.3 from June’s 55.4: only the sixth time in the past 11 months that the employment index has risen above growth neutral. “The area has been adding jobs at a slow and unspectacular pace for the last several months. Our index points to a continuation of this positive trend,” Goss said. “Both durable and non-durable manufacturing firms are expanding. Food processing is experiencing solid job additions.”

Wholesale prices: The prices-paid index, which tracks the cost of raw materials and supplies, expanded to 52.9 from June’s 50.5. At the wholesale level, we are tracking growth at a very moderate pace. Respondents were asked how the Midwest drought was affecting the costs of inputs purchased and sales of output sold by their companies. Only 5 percent reported negative impact on sales, while 18 percent reported increasing costs due to the drought. Over the next six months, companies expect the costs of supplies and materials to rise by 3.1 percent.

Inventories: Businesses expanded inventories. The July inventory reading was unchanged from June’s strong 60.4. “An inventory index above growth neutral is an indicator of an improving outlook by businesses. Businesses are adding to inventories in anticipation of growth in sales and production in the months ahead,” reported Goss.

Business confidence: Looking ahead six months, economic optimism fell to a weak 39.5 from 49.5 in June. “European economic turmoil, the impending fiscal cliff, national economic slowdown and national drought combined to push the confidence index to recession levels,” said Goss.

Trade: Firms experienced a pullback in new export orders: 44.6 vs. 67.7 in June. At the same time, the area’s import index slumped to 48.4 from 54.4 in June. “Weaker global growth and the rising value of the dollar making U.S. goods less competitive abroad pushed the export reading lower. Additionally, slower regional growth restrained the demand for imported supplies and materials. I expect trade numbers to weaken even more in the months ahead for the area,” said Goss.

Other components: New orders at 43.4, down from 51.7 in June; production or sales at 42.8, down from 52.3; and delivery lead time at 60.1, off of June’s 57.6.

For more information, contact Goss at 559-278-2352.

Related links: