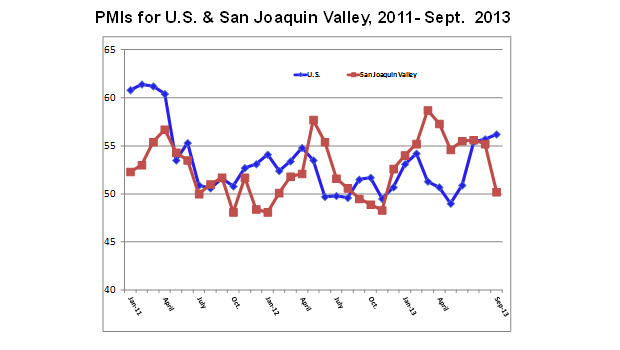

Despite declining in September, the San Joaquin Valley Business Conditions Index, produced by Fresno State’s Craig School of Business, remains above growth neutral for the 10th straight month. The overall September index dropped to 50.2 from 55.4 in August. An index of greater than 50 indicates an expansionary economy over the course of the next three to six months.

The index is a leading economic indicator from a survey of individuals making company purchasing decisions in the counties of Fresno, Madera, Kings and Tulare. The index uses the same methodology as that of the national Institute for Supply Management.

While the overall September index points to economic growth, Dr. Ernie Goss, a Craig School research faculty member who produces the index, says Washington politics are having a direct impact on local jobs.

“Uncertainty surrounding the Affordable Care Act and the budget stalemates in Congress are causing firms to be much more cautious about hiring and have encouraged layoffs and cuts in hours worked,” Goss said.

The survey found that 51.9 percent of businesses reported the Affordable Care Act had resulted in a reluctance to hire, reduced hiring, additional layoffs or a reduction in hours worked, Goss said. The remaining 48.1 percent of respondents reported no hiring or staffing impacts for their firms.

Other survey findings:

- Employment: Indicators remained above the growth neutral threshold, advancing slightly to 51.5 from August’s 51.2. Those figures are down sharply from the 54.2 index in July. Readings indicate the job market will continue to improve during the final months of 2013, but growth will be slow.

- Wholesale prices: The prices-paid index, which tracks the cost of raw materials and supplies, rose to 56.8 from 52.5 in August. Goss said wholesale inflationary pressures for the region are muted and prices over the past several months are consistent with inflation at the wholesale level.

- Business confidence: Indicators sank to 48.7 from August’s 51.1. According to Goss, the decline was due in large part to health care reform and the federal budget impasse. But he reports that federal spending sequestration has had very little effect, with only one in five companies reporting impacts from sequestration.

- Inventories: Business inventories remained sluggish in September. The index remained below growth neutral, dropping to an even weaker 43.3 from 46.3 in August.

- Trade: Export indicators slumped to 41.0 in September from August’s 42.7. At the same time, September’s import reading fell to 42.4, down from 50.5 in August. Goss said this reading is a signal that slower global economic growth and increases in the value of the U.S. dollar are having negative effects on sales abroad.

- Other components: The September Business Conditions Index showed new orders at 49.5, down from last month’s 60.9; production or sales at 51.5, down from 60.4 in August; and delivery lead-time at 55.1, down from 58.2 in August.

For more information, contact Goss at 559.278.2352.

Related Links: