For a third straight month, the San Joaquin Valley Business Conditions Index increased, rising above growth neutral, signaling slowly improving economic conditions ahead for the area, reported Dr. Ernie Goss, a research associate with Fresno State’s Craig School of Business.

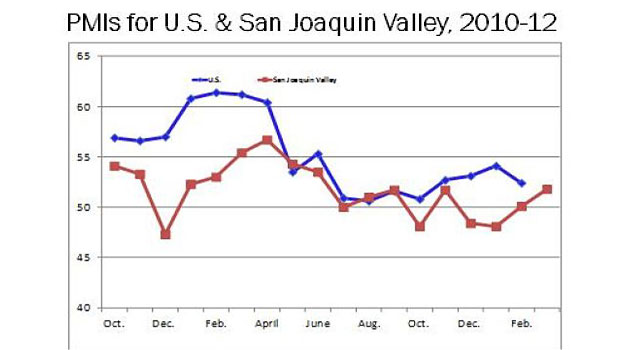

The index is a leading economic indicator from a survey of individuals making company purchasing decisions at firms in Fresno, Madera, Kings and Tulare counties. The index is produced using the same methodology as that of the national Institute for Supply Management (www.ism.ws).

Other key April survey results:

- Exports remain important contributor to growth.

- Inflation cools.

- Input prices expected to expand by a low 2.0 percent through 2012.

- Almost one-third indicated regulatory burdens were a big obstacle for their firm’s growth.

The index, produced by Goss rose to 52.1 from 51.8 in March. An index greater than 50 indicates an expansionary economy over the next three to six months. Survey results for the last two months and one year ago are listed in the accompanying table. “We are tracking a slowly improving economy,” said Goss. “As in the past several months, companies linked to agriculture and international markets are experiencing upturns in overall economic activity.”

This month survey participants were asked what federal action would most positively affect their company’s growth.

“More than one-third, 39 percent, reported that a reduction in federal spending would underpin long-term growth for their firm,” said Goss. “Another 29 percent indicated that a reduction in regulatory burdens would be the most beneficial public policy action to support their company’s growth.

“Fourteen percent supported a reduction in personal income taxes to boost their company’s sales and income growth,” added Goss. “No other factor garnered above single digit support.”

Other components of Goss’ index for April are as follows.

Employment: The hiring gauge climbed to a solid 55.9 from 54.6 in March – but only the third time in the past eight months that the employment index has risen above growth neutral. “We are tracking a job market that is improving, especially for durable goods producers linked to international markets and to food producers,” said Goss.

Wholesale Prices: The prices-paid index, which tracks the cost of raw materials and supplies, sank to 62.0 from 65.6 in March. “Even as prices for certain inputs continue to grow at an unsustainable pace, this pullback in overall input prices is very good news,” Goss said. “This month, we asked survey participants to project price hikes for the rest of 2012 for inputs that they buy. Owners and managers anticipate a very modest 2.0 percent increase and 39 percent of companies expect no increase or a price decline for inputs for the remainder of 2012. This downturn is certainly surprising to me, potentially stemming from a national and global economic slowdown,” said Goss.

Inventories: Businesses once again contracted inventories. The April reading advanced to a sub-growth neutral 46.2 from March’s weak 45.1. “An inventory index below growth neutral is an indicator of a negative outlook by businesses. Businesses are reluctant to add to inventories with this negative outlook,” reported Goss

Business confidence: Looking ahead six months, economic optimism, captured by the April business confidence index, rose to a tepid 51.9 from March’s 50.2 and February’s 47.3. “A dip in fuel prices and expanding regional growth more than offset concerns surrounding the nation’s employment conditions,” said Goss.

Trade: Firms experienced an upturn in new export orders with an April reading of 64.7, up from March’s very healthy 63.7. At the same time the area’s import index slumped to 53.6 from March’s 57.1. “Exports continue to be one of the most important factors driving growth in the area economy higher. Short of trading skirmishes or a strong dollar, I expect exports to remain healthy for the area,” said Goss.

Other components: New orders at 52.3 were down from March’s 56.4; production or sales at 50.1, down from 52.0; and delivery lead time at 56.1, up from 51.4 in March.

For more information, contact Goss at 559.278.2352.

Related links

- Follow Goss: Twitter at http://twitter.com/erniegoss or www.ernestgoss.com