For the first time since January, the San Joaquin Valley Business Conditions Index declined in June. However, the index prepared for the Craig School of Business at Fresno State remained above growth neutral 50.0 for the for the fifth straight month, signaling slowly improving regional economic conditions in the short term.

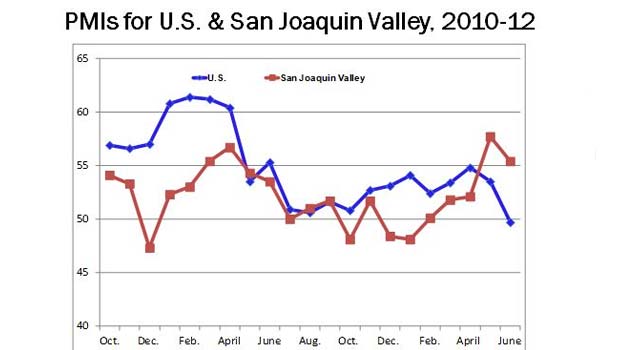

The index is a leading economic indicator from a survey of individuals making company purchasing decisions in Fresno, Madera, Kings and Tulare counties and is produced using the same methodology as that of the national Institute for Supply Management (www.ism.ws).

Here’s a look at other June survey highlights:

- More than one fourth of survey respondents see the end of Bush tax cuts as biggest business threat.

- Wholesale inflation cools again.

- Business confidence remains weak.

Overall: The index produced by Dr. Ernie Goss, a Craig School research associate, slid to a solid 55.4 from May’s stronger 57.7. An index greater than 50 indicates an expansionary economy over the course of the next three to six months. “We continue to trace a slowly improving economy,” said Goss. “As in the past several months, companies linked to agriculture and international markets are experiencing significantly improving business activity.”

Supply managers were asked the biggest negative hurdle facing their firm in the next year. The largest share, 27 percent, indicated that the end of the so-called Bush tax cuts at year’s end posed the biggest threat to their company’s 2013 business. That was followed by continuing difficulties in the housing sector, 25 percent; the European economic turmoil, 22 percent; and implementation of healthcare reform and lack of wage growth, 13 percent apiece.

Employment: The hiring gauge dipped to 55.4 from May’s 57.9, only the fifth time in the past 10 months that the employment index rose above growth neutral. “However, we are tracking a job market across most industries in the area, even construction. I expect this growth to continue but at a somewhat slower pace for the second half of 2012,” Goss said. “For the first five months of 2012, the Valley expanded jobs by 2.3 percent compared to no gain for the same period in 2011.”

Wholesale prices: The prices-paid index, which tracks the cost of raw materials and supplies, sank to 50.5 from May’s 56.0 and April’s even stronger 62.0. “Slower economic growth, European economic turmoil and a stronger dollar are all contributing to declining inflationary pressures. “The degree to which inflationary pressures have cooled has surprised me. This is an important signal and indicates that the Federal Reserve can become more aggressive in its stimulation of the U.S. economy without any significant inflation fears,” said Goss. “However given current short- and long-term interest rates, there is little the Fed can do to push growth higher especially with the national elections ahead. The last thing the Fed wishes to do is enter the political fray by abruptly changing policy.”

Inventories: The June inventory reading advanced to 60.4 from 53.1 in May. “An inventory index above growth neutral is an indicator of an improving outlook by businesses. Businesses are adding to inventories in anticipation of growth in sales and production in the months ahead,” reported Goss.

Business confidence: Looking ahead six months, economic optimism, advanced to a weak 49.5 from 46.8 in May. “While survey respondents are more optimistic about their own company’s prospects, they remain fairly pessimistic regarding the overall economy,” reported Goss.

Trade: For June, firms experienced much stronger growth in new export orders with a reading of 67.7, well up from 53.5 in May. At the same time the area’s import index expanded to 54.4 from 53.9 in May. “Contrary to what we are seeing at the national level, orders from abroad continue to grow at a healthy pace,” said Goss. “They have been an important factor driving growth in the regional economy higher. However, I expect slower global economic growth and gains in the value of the dollar to slow growth in new export orders in the months ahead.”

Other components: New orders at 51.7, down from 58.2 in May; production or sales at 52.3, down from 59.0; and delivery lead time at 57.6, off May’s 60.2.

For more information, contact Goss at 559-278-2352.

Related links:

- Craig School of Business

- Follow Goss: Twitter at http://twitter.com/erniegoss or www.ernestgoss.com