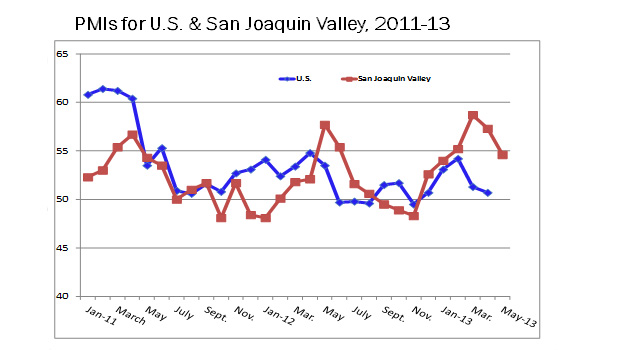

Fresno State’s Craig School of Business San Joaquin Valley Business Conditions Index continues to point toward growth despite declining for the second straight month. The overall index slid in May to 54.6 from 57.3 in April. An index of greater than 50 indicates an expansionary economy over the course of the next three to six months.

“Expanding economic conditions in the region’s construction industry continue to boost growth prospects for the region, with firms linked to housing experiencing improving economic conditions,” said Dr. Ernie Goss, a research faculty from the Craig School who produces the index. “A boost in new export orders for the month also supported the overall reading.”

The index is a leading economic indicator from a survey of individuals making company purchasing decisions in the counties of Fresno, Madera, Kings and Tulare. The index uses the same methodology as that of the national Institute for Supply Management.

Looking ahead six months, economic optimism, captured by the business confidence index, dipped to 51.6 from April’s 55.7, but is higher than March’s 50.4.

“The last three months we asked survey participants who make purchasing decisions for their firms how the federal spending sequestration was affecting their company. Almost 80 percent indicated that the cuts had no impact on their company to date. Less than 20 percent reported only modest impacts. None of the businesses reported significant impacts,” said Goss.

Other survey findings:

- Employment indicators remain strong, despite the job index dipping to 55.7 from 56.7 in April. The May reading is above the growth neutral threshold for a seventh straight month, indicating that the job market is expanding and will continue to improve. Businesses expect wages and salaries to expand by approximately 1.5 percent over the next year, up from January when a yearly gain of 1.1 percent was projected

- Wholesale prices decreased from 63.5 in April to 62.0 in May according to the prices-paid index, which tracks the cost of raw materials and supplies. Survey participants indicated that they expect wholesale prices to grow by 4.8 percent on average in the next year. This is down significantly from January’s estimate of 7.2 percent.

- Inventories dropped for businesses this month. The index sank to 46.3 from 50.9 last month. Goss said this finding was the only negative to come from May’s report.

- Trade export indicators soared in May to 59.9 from 47 in April. At the same time, May’s import reading moved lower but remained above growth neutral at 50.8 from April’s 51.5.

- Other components of the May Business Conditions Index were new orders at 55.3, down from 58 last month; production or sales at 59.3, down from April’s 63.5; and delivery lead-time at 56.4, off slightly from 57.2 in April..

For more information, contact Goss at 559.278.2352.

Related Links: