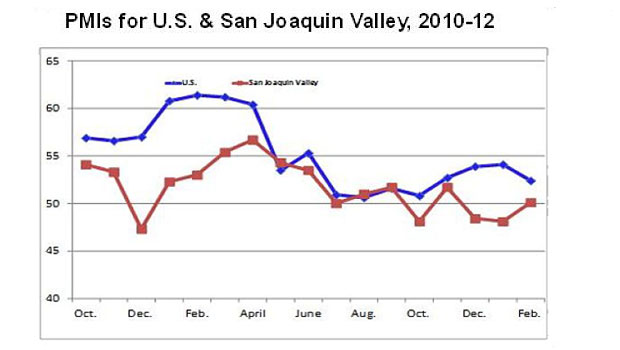

For the first time since November, the San Joaquin Valley Business Conditions Index moved above growth-neutral 50.0, signaling improving economic conditions for the area in the months ahead.

The index is compiled for Fresno State’s Craig School of business by Dr. Ernie Goss, a research associate.

The Valley Business Conditions Index is a leading economic indicator reflecting a survey of individuals making company purchasing decisions in Fresno, Madera, Kings and Tulare counties. The index is produced using the same methodology as that of the national Institute for Supply Management (www.ism.ws).

February survey results at a glance:

- Leading economic indicator moves above growth-neutral.

- Wholesale inflation gauge climbs higher.

- New export orders rise dramatically.

The overall Index rose to 50.1 from 48.1 in January and 48.4 in December. An index greater than 50 indicates an expansionary economy over the course of the next three to six months. The index was at 53.0 a year ago.

“A large share of firms reported that very healthy new export orders were an important driver of the February improvement. Firms in the area tied to agriculture and energy continue to benefit from the cheap-dollar policy of the Federal Reserve. The cheap dollar makes U.S. goods more competitively priced abroad,” said Goss.

Employment: The hiring gauge slumped to a very weak 44.8 from January’s 47.0. This is the seventh time in the past eight months that the employment index has plunged below growth neutral. “Although the overall number was stronger for February, firms in the region continue to shed jobs,” said Goss. “But I do expect improvements in new orders to translate into a slightly better job picture for the unemployed in the months ahead. However, a weak construction sector continues to weigh on the Valley economy.

Wholesale prices: The prices-paid index, which tracks the cost of raw materials and supplies, rose to 62.4 from 57.2 in January. “While the index remains in a range indicating only modest wholesale inflation, I expect the Fed’s cheap-dollar policy to push prices up at a significantly higher pace in the months ahead. Last month, the Fed indicated that it would maintain current record-low, short-term interest rates until 2014. In my judgment, this pro-growth stance poses significant inflation risks,” Goss said. “Not only are current prices rising, our survey participants expect future prices to rise at an unacceptably high rate in the next six months,” Goss added. “I believe inflationary pressures in the coming months will be much too high for the Fed to be so aggressive in terms of low interest rates that cheapens the dollar and fuels inflation.”

Inventories: Businesses once again contracted inventories for the month. However, the index, which tracks the change in the inventory of raw materials and supplies, was less negative, expanding to 49.5 from January’s 46.2. Said Gross, “An inventory index below growth-neutral is another indicator of a negative outlook by businesses.”

Business confidence: Looking ahead six months, economic optimism, captured by the February business confidence index, rose to a still weak 47.3 from 47.0 in January. “Thus far, an improving national job picture has failed to boost business confidence in the Valley,” said Goss.

Trade: For the first time since June, firms experienced an expansion in new export orders, with a February reading of 58.9, up significantly from January’s 42.8. At the same time the area’s import index dipped to 48.6 from 51.8 in January. “The Federal Reserve’s cheap-dollar policy has made U.S. goods more competitively priced abroad and pushed up export orders. Historically exports have been an important growth factor for the San Joaquin Valley,” said Goss.

Other components: Other components of the February Business Conditions Index were new orders at 50.3, up from 46.4 in January; production or sales at 50.8, up from 46.8 in January; and delivery lead time at 55.9, up from January’s 54.3.

For more information, contact Goss at 559.278.2352.

Related links: