Fresno State’s Craig School of Business San Joaquin Valley Business Conditions Index declined below growth neutral for a second straight month, signaling slow to no growth for the region in the months ahead.

October’s other key results:

- Businesses expect 2012 holiday sales to grow by 2.1 percent from 2011 levels, less than half the growth considered healthy.

- 21.2 percent of survey participants expect 2013 recession and nearly two-thirds say a recession is a 50-50 possibility.

- Business confidence remains very weak.

Survey participants were asked to gauge the likelihood of a 2013 recession and just over one in five believe it’s likely or very likely. Only 15.2 percent believe a 2013 recession is unlikely, while the remaining 63.6 percent think there’s an even chance of a recession.

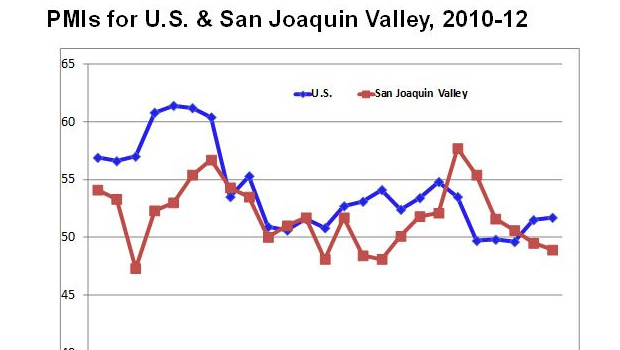

The Valley index is a leading economic indicator from a survey of individuals making company purchasing decisions in Fresno, Madera, Kings and Tulare counties. It is produced by Dr. Ernie Goss, a research association with the Craig School who uses the same methodology as the national Institute for Supply Management (www.ism.ws).

In October, the overall index dipped to 48.9 from 49.5 in September. An index greater than 50 indicates an expansionary economy over the next three to six months. “Our survey results point to slightly negative growth. The national ISM index has now moved above growth neutral for two straight months,” said Goss.

Other key areas were not encouraging:

- Employment moved below the growth neutral threshold for October as the job index sank to 49.4 from September’s 50.4. “The area has been adding jobs but at a very slow pace,” reported Goss. “Our surveys over the past several months point to slightly negative job growth for the next three to six months. Our surveys are tracking pullbacks in nondurable goods firms such as food processors, which is expected to spill over into the broader economy.”

- Wholesale prices paid for raw materials and supplies expanded to an inflationary 65.2 from 62.1. Goss said wholesale prices are increasing at an expanding pace.” The Federal Reserve’s latest stimulus, quantitative easing 3 (QE3), and rising food and energy prices are pushing the wholesale price gauge well above acceptable levels,” he added. “I expect this to show up in higher consumer prices in the months ahead, limiting the Fed’s options regarding further monetary easing.”

- Business confidence over the nextsix months advanced to a very weak 39.8 from 36.1in September. “Even as the economic conditions in the housing sector have improved, the area’s business sector remains very pessimistic regarding future economic conditions,” said Goss. “The fiscal cliff, the elections and European economic turmoil are all weighing on economic confidence.”

- Holiday sales are not expected to be robust, with survey respondents predicting very low 2.1 percent growth over 2011. Approximately 27.5 percent expect a gain of more than 4 percent, but 17.2 percent expect a decrease. “To be considered healthy, holiday sales should grow in excess of 5 percent from previous year sales,” said Goss.

- Inventories declined to 50.9 from 55.4 in September. “Given the other negative indicators in our last two surveys, it is likely that the lower inventory reading is the result of a downturn in expected future sales,” reported Goss.

- In trade, new export orders for October were still very weak (35.9 vs. September’s 33.5), but imports contracted for the month (46.6 vs. 43.2). “Weaker global and area growth are weighing on both foreign purchases and sales,” said Goss.

- Other components of the October Business Conditions Index were new orders at 43.1, up from 41.2 in September; production or sales at 47.8, up from September’s 45.6; and delivery lead time at 53.3, down slightly from September’s 54.8.

For more information, contact Goss at 559.278.2352:

Related links:

- Craig School of Business: http://www.craig.csufresno.edu/

- Follow Goss: Twitter at http://twitter.com/erniegoss or www.ernestgoss.com